Budgeting for baby: How to financially prepare for parental leave

There's no shortage of things for new parents to prepare for when welcoming a baby, including a creating a baby budget. While your to-do list may be lengthy, making a financial plan for your parental leave will allow you to reduce financial stress and focus on your family.

We’ve created three simple steps to help you feel prepared and flexible as you plan for your child’s arrival and create your baby budget.

Step 1: Estimate your post-baby income

Figure out what your post-baby or parental leave income will be. Your income while on parental leave will depend on your workplace benefits and the type of government parental leave you choose to take. Make sure to review all workplace and government benefits in full for your entire family to properly estimate your parental leave income.

In Canada, most working residents are eligible for the following benefits:

1. Maternity and parental leave benefits

Most working Canadians are eligible to receive some sort of parental leave benefits from the government. Currently, in 2022, if you qualify, you will generally receive 55% of your earnings, up to a maximum of $638 a week for 35 to 55 weeks, or you can choose the extended option and receive 33% of your earnings, at a maximum of $389 a week, up to 76 weeks. Depending on the option you choose and if you're the parent who gave birth, you may see a change in how much you receive and how long you can be on leave.

The Government of Canada’s website explains the qualifications, limitations, and expected coverage of maternity and parental leave benefits, so you can accurately estimate your monthly amount.

2. Child and family benefits

Once your baby is born, you can qualify for the Canada Child Benefit through the CRA and other provincial family funding. To find out how much you might be eligible for, use the CRA’s child and family benefits calculator.

3. Employer benefits

Many employers offer top-up programs to help supplement your parental leave benefits. When you’re ready to disclose the news to your manager, check to see what coverage or additional benefits they might offer for new parents. If you've extended healthcare benefits through your employer, double-check your eligibility and the full terms of coverage. This is also a great time to review your benefits package to see what extras may be covered while you’re at the hospital and how to add your baby to your insurance plan.

Step 2: Make a pre-baby budget

Review your current budget and determine what you might need to spend before your baby’s arrival. If your finances are in the negative, meaning that your expenses are higher than your income, you’ll need to think about ways you can cut back on spending or increase your income. If you’re in a surplus, you’re well-positioned to plan for pre and post-baby expenses. Here are some tips:

- Open a savings account or investment plan, such as a TFSA, to save any surplus funds for a post-baby budget, an emergency fund, or your child’s future.

- Put the money towards “start-up costs,” such as a crib, car seat, clothes, diapers, formula, bottles, etc. You’ll likely purchase a lot of items before your little one arrives, so setting aside your surplus funds to cover these expenses is a great way to get a head start.

- Pay down your debt so that you aren’t worrying about payments as a new parent. This will also create a more positive cash flow, allowing you to easily cover the additional costs.

If you’re currently living paycheque to paycheque or will be while on parental leave, it’s time to start finding ways to reduce your expenses before the baby arrives. Ask yourself these questions:

- Can you cut back on certain non-baby-related expenses so you can save more for your parental leave?

- Are there expenses that you can cut back on during your parental leave to help subsidize baby costs? Are there any baby items you can purchase second-hand or borrow from a family member or friend?

Step 3: Make a budget and stick to it

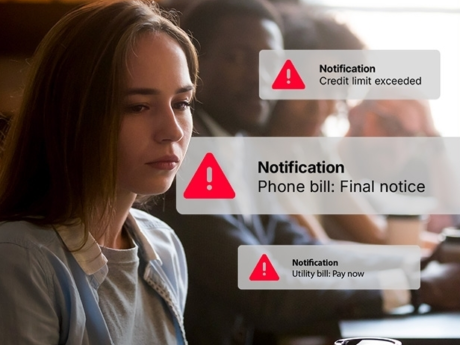

When your baby arrives, you aren’t going to have a lot of time or energy for complicated tasks like budgeting. Give your future self a break by creating a budget based on your parental leave income and expenses before your baby arrives. Having this set up in advance will be one less thing for you to think about. You can also try to set up automated payments for the year so you don’t have to keep track of when bills are due, and most banks now offer budgeting features or spending notifications that can help you stay on top of your budgeting while you are otherwise occupied with parenthood.

To learn how to create and basic budget and stick with it, check out our budgeting blog.

Managing debt while becoming a new parent

Having debt while trying to prepare for a new baby can be overwhelming, but you aren’t alone! If your debt payments are unmanageable or will be harder to meet while on parental leave, consider making alternative arrangements with your creditors with the help of a Licensed Insolvency Trustee. At Grant Thornton Limited, our Licensed Insolvency Trustees (LITs) can negotiate with your creditors and help you and your family get a fresh start! Call today for your free consultation, or book one online.

About the Author

Take the first step to debt freedom

Speak to one of our debt solutions professionals during a free, no-obligation consultation.

Related articles

How can a Licensed Insolvency Trustee help with my debt?

What Canada’s 2025 federal budget could mean for your taxes—and your wallet

Is AI your new best budget buddy?

5 questions to help you plan a debt-free wedding

The rising cost of friendship in Canada

How to budget as a single parent

How tariffs impact Canadians—and how to prepare if you’re facing debt

Looking for assurance, tax, and business advisory services? Visit Doane Grant Thornton LLP.

Loading