The rising cost of friendship in Canada

Friends are the family we choose—but what happens when the cost of connection becomes too high? Our latest survey reveals that for many Canadians, financial strain is quietly reshaping how we socialize, support, and sustain our friendships.

We’re living in a time when the rising cost of living touches every part of life—even our relationships. We asked Canadians how their financial situation has shaped their social life. Our survey found that 2 in 5 Canadians have missed out on spending time with friends due to financial constraints. For younger generations, the impact is even greater—half of Gen Z and Millennials have skipped social outings because of cost, compared to just a quarter of Boomers.

Bonding on a budget

Despite rising costs, Canadians are still finding ways to stay connected on a budget. 59% of Canadians spend less than $100 when out with friends, and half of Gen Z keep it under $50. Whether it’s a coffee catch-up, a quick weekday lunch, or an evening out, meaningful moments don’t always have to break the bank. Younger generations are finding creative ways to enjoy time with friends without spending beyond their means. Instead of dining at expensive restaurants or splurging on nights out, many are turning to more budget-friendly alternatives—like hosting potlucks at home, organizing park picnics, or exploring free community events. These low-cost gatherings not only ease financial pressure but often feel more personal and meaningful.

Technology also plays a key role in bridging the gap. Video calls, group chats, and shared playlists allow friends and families to stay close, even when distance or tight budgets keep them apart. Virtual game nights, movie watch parties, and collaborative cooking sessions have become popular ways to maintain bonds—without spending a dime.

The debt behind the dinner

Is it normal to go into debt to see friends? The pressure to keep up socially can come at a cost, so it’s becoming more common to spend outside of your means just to stay social. 1 in 5 Canadians have taken on debt in the past two years just to spend time with friends—from dinners to destination getaways. Gen Xers are feeling it most, with 1 in 3 reporting debt for social reasons—the highest of any generation.

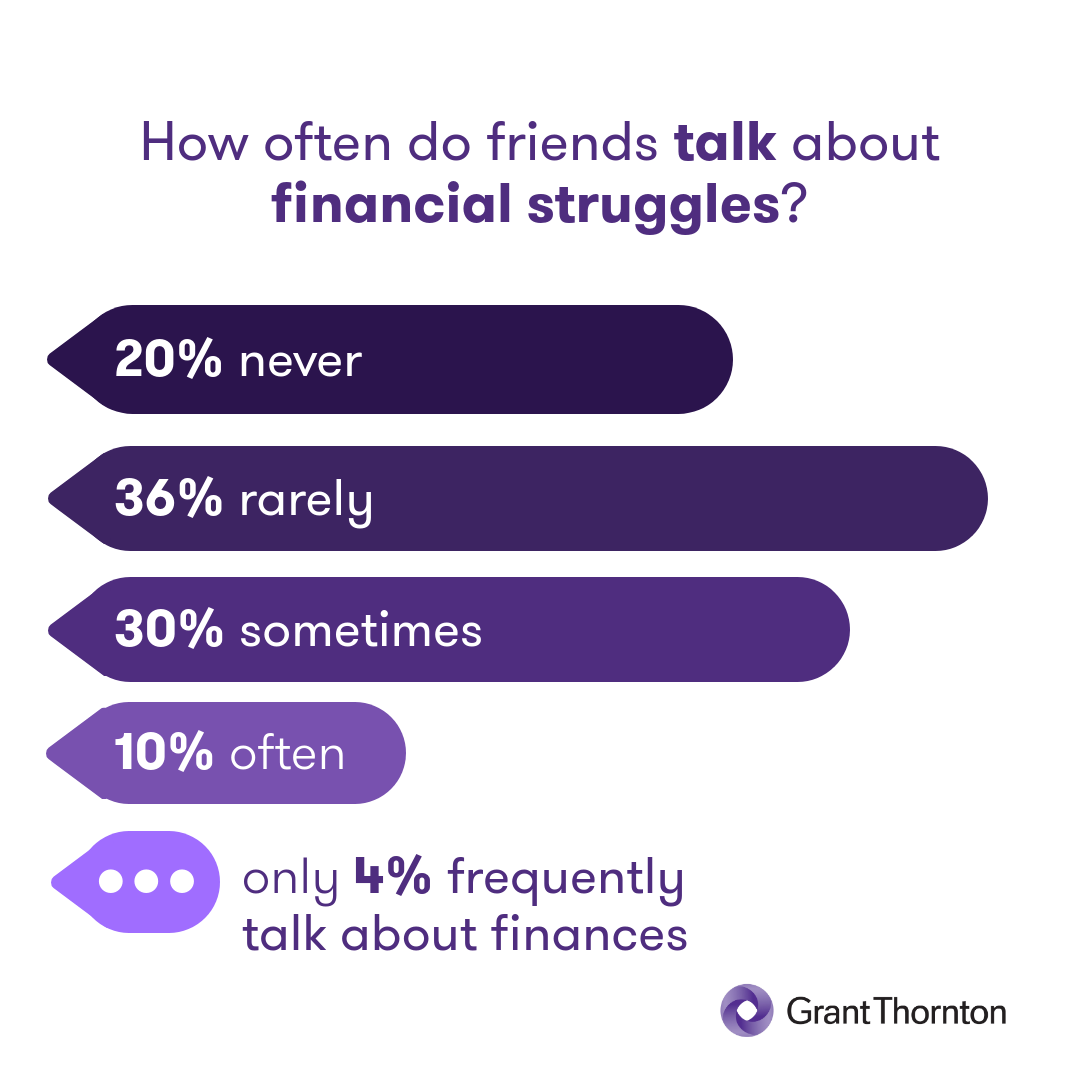

Let’s talk about debt

Money talk between friends is still taboo for many—20% of Canadians never discuss finances with friends. But younger Canadians are breaking the silence. 24% of Gen Z and Millennials talk about money regularly, compared to just 4% of Boomers.

This shift could be attributed to younger generations valuing transparency, and the influence of social media normalizing these conversations. Financial discussions among young Canadians is important—it can lead to better financial literacy, shared resources and mutual support.

Lending a hand—and a few dollars

Friendship often means being there for each other in tough times. Over half of Canadians have lent money to a friend, with 18% lending over $100 and 10% lending over $1,000. Gen Z and Millennials are the most generous, with over 60% having financially supported a friend. But this generosity can come at a cost—not just financially, but emotionally.

A loan that goes unpaid could end up being a point of contention. The friend who lent the money may feel taken advantage of, while the borrower may feel ashamed or pressured—especially if they can't repay it quickly. These unspoken tensions can erode trust and create awkwardness that lingers long after the money is spent. For younger Canadians who are already navigating student debt, housing insecurity, and an unstable job market, the emotional toll of mixing money and friendship can be especially high.

Talking about money and debt with friends can be intimidating, but talking to us doesn’t have to be. If money is getting in the way of your relationships—or your peace of mind—we’re here to help. Book a free consultation with one of our debt solutions professionals today.

Take the first step to debt freedom

Speak to one of our debt solutions professionals during a free, no-obligation consultation.

Related articles

How can a Licensed Insolvency Trustee help with my debt?

Do you owe CERB debt? Here's what Canadians need to know about repayment

How much debt is normal in your province?

What Canada’s 2025 federal budget could mean for your taxes—and your wallet

4 common investment scams and how to avoid them

Is AI your new best budget buddy?

Should I get a store credit card?

Looking for assurance, tax, and business advisory services? Visit Doane Grant Thornton LLP.

Loading