How much debt is normal in your province?

Having debt is a reality for most Canadians—whether it’s student loans, credit cards, or car payments. But can the province you live in impact the amount of debt you have? In this article, we explore debt by province and how each region stacks up compared to the rest of Canada.

According to Equifax, the average Canadian owes just shy of $22,000 in non-mortgage debt. But that number doesn’t tell the whole story. Where you live can have a big impact on how much debt you carry and why. From groceries to rent, insurance to income, the cost of living varies widely across Canada.

Comparing yourself to others can help you spot financial red flags—but remember, your situation is unique. Below, we break down what debt looks like in each province, why people are struggling, and what you can do about it.

Here’s a quick look at average debt and delinquency rates by province for the first quarter of 2025:

Province | Average debt | Delinquency rate |

Ontario | $22,543 | 1.73% |

Nova Scotia | $21,296 | 1.68% |

New Brunswick | $21,490 | 1.77% |

PEI | $23,707 | 1.19% |

Newfoundland | $24,770 | 1.56% |

Alberta | $24,398 | 1.97% |

Manitoba | $18,171 | 1.72% |

Saskatchewan | $23,194 | 1.82% |

British Columbia | $22,631 | 1.40% |

Canada (avg) | $21,859 | 1.60% |

Source: Q1 2025 | Equifax Canada Market Pulse Quarterly Consumer Credit Trends

Find your province:

- Personal debt in Alberta

- Personal debt in British Columbia

- Personal debt in Manitoba

- Personal debt in New Brunswick

- Personal debt in Newfoundland and Labrador

- Personal debt in Nova Scotia

- Personal debt in Ontario

- Personal debt in Prince Edward Island

- Personal debt in Saskatchewan

- Personal debt in the Territories

Personal debt in Alberta

Alberta’s economy has grown rapidly since the oil boom of the 2010s, but that growth came with a higher cost of living. Today, the average home price is close to half a million dollars. When it comes to personal debt, Albertans carry the second highest average in Canada at $24,398 and the province leads delinquency rates at 1.97%.

Why Albertans are in debt

Vehicle costs. Alberta’s unique mix of rural and urban communities often means long commutes and expensive vehicles. The average new car in Alberta costs $68,733, and insurance runs about $3,151 per year, the highest in the country.

Low income. Full-time workers that seek debt help in Alberta earn less than the provincial average income of $74,237, and many residents are self-employed or work as contractors. Irregular or self-employed work can also lead to tax debt which one in five insolvent Albertan’s struggle with.

Employment instability. Employment challenges are another factor. While three-quarters of Albertans who file for insolvency work full-time, job instability is frequently cited as a reason for filing. The oil industry’s fluctuations create irregular income and periods of unemployment, making it harder to stay financially stable.

Debt advice for Albertans

If you’re concerned about job security or are struggling with CRA debt, planning ahead is key. Falling behind on payments can escalate quickly, affecting both your finances and your lifestyle. The good news is that there are options available, learn more about debt relief options in Alberta or book a free consultation with us.

Personal debt in British Columbia

British Columbia is beautiful—but living there comes at a price. The province is known for its sky-high real estate costs, with the average home priced at over $1 million and rent averaging $2,656. Even a studio apartment costs $1,948. Food prices are also steep, despite local production on the mainland.

And while costs soar, wages don’t always keep up—the average annual income is $66,232. Despite this gap, BC has one of the lower average debts at $22,631 and the lowest delinquency rate in Western Canada at 1.40%.

Why British Columbians are in debt

Income issues. BC’s size and diversity mean a wide range of financial challenges. Unlike other provinces, only half of BC debtors who file for insolvency work full-time. The rest are retired, self-employed, part-time, or living with disabilities. Health issues are a leading reason for filing. Even with provincial healthcare, costs like time off work, travel for treatment, and long-term complications add up.

Marital breakdown. One in four insolvent British Columbians are divorced or separated. Credit cards dominate the debt landscape, accounting for 25% of reported debts, mostly from major banks. And while more than 10% of residents have tried solutions like consolidation loans, many need more aggressive debt management options.

Debt advice for British Columbians

Divorce and separation can be financially and emotionally challenging, so make sure to know the cost before making the decisions. If poor credit is making it hard to rent, there are still ways to secure housing. And remember, you don’t have to face debt alone—learn more about debt relief options in British Columbia or book a free consultation with us.

Personal debt in Manitoba

Manitoba offers a lower cost of living while still providing big-city amenities in cities like Winnipeg. It even holds the lowest average debt in Canada at $18,171, more than $800 below the next lowest province. But Manitoba still sees a relatively high delinquency rate of 1.72%, which may be linked to wage stagnation.

Why Manitobans are in debt

Cost of living. Salaries remain modest at $58,500, the lowest in Western Canada and far behind its neighbour Saskatchewan. While local food production helps keep grocery costs down, other expenses are harder to manage. Rent averages $1,431, and homes cost about $403,587, which can be difficult to afford on top of rising property tax and utilities.

Low income. Three-quarters of Manitoba debtors have some form of post-secondary education—likely due to one of the lowest tuition rates in Canada at $5,386—yet many still say their income isn’t enough to cover expenses. Seasonal work in agriculture and manufacturing adds further financial uncertainty, making it difficult to save for emergencies.

High interest debt. Debt often comes from utilities and taxes, which accounts for 14% of reported debt by Manitoba debtors. Tax debt is another issue: 20% of Manitobans list the CRA as a top creditor, with some owing more than $30,000. Provincial newcomers' programs may lead to immigrants struggling to navigate Canada’s credit system.

Debt advice for Manitobans

If you work in a seasonal or irregular industry, budgeting is essential. Planning for income fluctuations can help avoid overreliance on credit cards. Watch for early signs of credit trouble and start paying down balances before they spiral. And if CRA debt feels overwhelming, know that there are ways to manage it.

Whatever your situation, we’re here to help you explore solutions and get back on track. Learn more about debt relief in Manitoba, or book a free consultation with us.

Personal debt in New Brunswick

New Brunswick is the gateway to the Maritimes and has been rising in popularity and population. Despite a slightly lower cost of living, financial challenges remain. The province’s average consumer debt is $21,490, and it holds the highest delinquency rate in Atlantic Canada at 1.77%.

Why New Brunswickers are in debt

Cost of living. Rent in New Brunswick is significantly below the national average at $1,485, and homes average $330,000. But owning a home can come with financial risks and uncertainties. It also limits the number of debt solution options available. NB has high home ownership rates of those that filed with Grant Thornton. 1 in 5 New Brunswick debtors own a home, the highest rate in the country.

Lower income. New Brunswick also has lower wages than other provinces and is the highest taxed, which may make it hard to stay ahead. Three quarters of New Brunswickers that sought help from Grant Thornton work full-time yet still can’t afford all their expenses. Many residents rely on cars due to limited public transit and long distances between major cities, and list car loans and utility bills as common sources of debt. Adding to the strain, large companies have pulled out of the province, leaving gaps in employment and pushing more residents toward self-employment.

Debt advice for New Brunswickers

Medical issues and unemployment are frequently cited as reasons for debt in New Brunswick. In these financially stressful situations, residents often fall back on payday loans and other high-interest credit options. Setting up an emergency fund can help absorb some of these unexpected costs before relying on debt. If you need a vehicle, make sure to stay on top of payments to avoid repossession. If you’re in New Brunswick and struggling, keep a close eye on utility costs and avoid high-interest loans. We can help you explore better options. Learn more about debt relief in New Brunswick, or book a free consultation with us.

Personal debt in Newfoundland and Labrador

Newfoundland and Labrador top the charts for average debt in Canada at $24,770, even though housing costs are among the lowest—just $406,100 on average. Home ownership is high at 75%, but incomes are modest at $52,562, and essentials like groceries and insurance rank among the most expensive nationwide.

Why Newfoundlanders and Labradorians are in debt

Cost of living. Unlike most provinces where housing dominates household budgets, Newfoundlanders and Labradorians spend nearly as much on food and transportation as they do on housing. Many debtors are married homeowners with post-secondary education, yet overextension and rising utility costs like heating can create financial strain.

Seasonal work. Job opportunities and income often dip during the most expensive months, making it harder to keep up and because Newfoundland’s vast landscape makes car ownership essential, residents frequently owe significant amounts to car dealerships.

Debt advice for Newfoundlanders and Labradorians

If you’re buying a home, take time to understand every detail of your contract—from interest rates to policy types—and factor in additional expenses like utilities and maintenance. For those facing medical travel costs or struggling with car payments, an emergency fund can provide a much-needed buffer. And if debt feels overwhelming, we can help you get back on track. Learn more about debt relief in Newfoundland and Labrador or book a free consultation with us.

Personal debt in Nova Scotia

Nova Scotia’s charm and coastal beauty come with a high and continuously rising cost of living. The province’s average debt sits at $21,296—below the national average—but its delinquency rate has climbed to 1.68% in the last year.

Why Nova Scotians are in debt

Cost of living. Halifax rent is now the third highest in Canada at $1,892, and the average home costs nearly $450,000. Meanwhile, the average income remains the third lowest in the country at $56,550. Seasonal work in fishing, tourism, and retail makes incomes unpredictable, and student loans add extra pressure. Nova Scotia has the highest tuition in Canada at $9,575, which means graduates often start their careers in significant debt.

Marital breakdown. Personal circumstances also play a role: one in five Nova Scotia debtors are divorced or separated, which can lead to higher living costs as well as spousal or child support payments. Even homeownership can be a double-edged sword for Nova Scotians with rising utility and home maintenance costs.

Debt advice for Nova Scotians

Many Nova Scotians also owe money to the CRA, often due to irregular income or lingering CERB repayments. If that’s you, don’t panic—there are ways to reduce your debt and stop interest from piling up. Arranging your budget seasonally can make a big difference in regulating fluctuations in income and living expenses. Stay on top of tax deductions, and if you’re struggling with CRA or other creditors, we can help stop interest and reduce what you owe. Learn more about debt relief in Nova Scotia or book a free consultation with us.

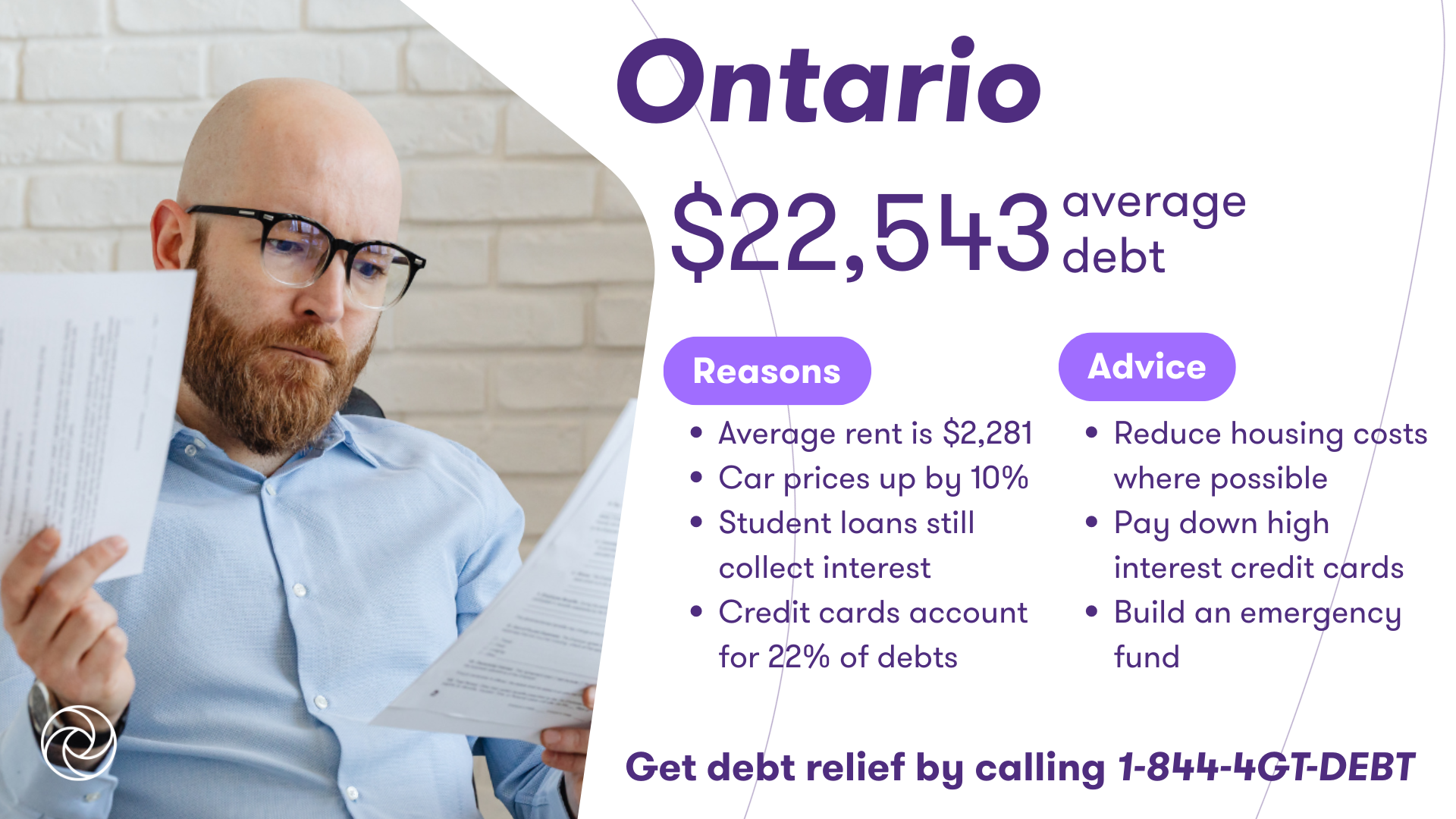

Personal debt in Ontario

Ontario is home to some of Canada’s most expensive housing markets—especially in Toronto and the surrounding region. On top of housing, Ontario residents owe on average $22,500 in non-mortgage debt. While it’s not the highest amount in Canada, Ontarians are finding it tough to keep up with payments—as delinquency rates in the province climb faster there than anywhere else.

Why Ontarians are in debt

Cost of living. Groceries may be cheaper than in other regions due to its central location, but Ontario still has some of the highest rent and vehicle costs in the country. A one-bedroom apartment averages $2,281 per month, and houses can cost upwards of $800,000. New car prices have climbed 10% between 2023 and 2024, driven by factors like higher demand, larger vehicles, and lingering supply chain issues, reaching $65,645. For those outside major city centers, owning a vehicle is often a necessity.

Employment instability. Most people who file for insolvency in Ontario list employment instability or loss of income as their reason for filing. Of those who filed with Grant Thornton, over half are employed, but earn significantly less than the provincial average, just $38,535 compared to $63,369. Many households also rely on a single income to get by and reach for credit to bridge financial gaps.

Reliance on loans. Many Ontarians rely on loans to offset the cost of living. Of those who filed with Grant Thornton, student loans top the list, partially due to Ontario being one of the few provinces that still charges interest on provincial student loans. Credit cards account for 22% of reported debts, and one in ten Ontarians have turned to payday loans to make ends meet.

Debt advice for Ontarians

Housing is the biggest expense for most Ontario residents. If possible, reducing housing costs can make a big difference in your budget. A common option is to live with roommates or family.

You should also prioritize paying down high-interest debt—like credit cards and payday loans—and build an emergency fund to cushion against income loss.

If unemployment or financial stress is making it hard to get back on track, we’re here to help you explore your options. Learn more about debt relief in Ontario or book a free consultation with us.

Personal debt in Prince Edward Island

Prince Edward Island may be Canada’s smallest province, but its financial hurdles are big. Islanders carry an average debt of $23,707, and while the delinquency rate is relatively low at 1.19%, incomes remain the lowest in the country at just $46,160.

Why Prince Edward Islanders are in debt

Irregular income. Seasonal work in agriculture, fisheries, and tourism creates income gaps for many residents. Rising rent and home prices—averaging $364,700, the second highest in Atlantic Canada—add to the strain. A growing trend of converting long-term rentals into vacation properties is pushing housing costs even higher and reducing rental availability.

Employment instability. One in five PEI debtors is unemployed, and another one in five works only part-time or seasonally. Half of PEI debtors are single, meaning they have to manage the rising costs on a single income.

Debt advice for residents of Prince Edward Island

Credit card debt—especially store cards—is common in PEI. On top of that, the average debtor that files with Grant Thornton owes more than their monthly income to the CRA, roughly $6,000, often due to self-employment or contract work. If this sounds familiar, consider budgeting for seasonal income fluctuations and steering clear of high-interest store cards. These small steps can make a big difference, and we can help. Learn more about debt relief in Prince Edward Island or book a free consultation with us.

Personal debt in Saskatchewan

Saskatchewan has long been considered one of Canada’s most affordable provinces. It boasts the highest average income in the country at $88,424, low rent prices—one of only two provinces where a studio apartment averages under $1,000—and even below-average food costs.

So why does the average Saskatchewan resident owe $23,194, more than $1,000 above the national average? And why does the province have the second-highest delinquency rate at 1.82%, just behind Alberta?

Why Saskatchewanians are in debt

Cost of living. While living costs are relatively low, they’ve risen sharply in recent years, making it hard for Saskatchewanians to adjust their budgets. Rapid interest rate hikes have also hit hard with many who borrowed expecting low rates now struggling to keep up.

Existing debt and marital breakdown. Saskatchewan attracts newcomers from other provinces seeking affordability, but many bring existing debt with them. Among those filing for insolvency, 80% work full-time, yet earn only about half the provincial average income. Over half are single or separated, and one-third have at least one child, which adds financial pressure even in a lower-cost province.

High interest debt. Many turn to credit cards and payday loans to fill the financial gaps but still find themselves falling behind. Store credit cards are especially popular, making up 10% of all creditor accounts—but these products often carry extremely high interest rates, which can quickly spiral out of control.

Debt advice for residents of Saskatchewan

Be cautious with store credit cards and payday loans—understanding the terms before signing up can save you from costly surprises. If you’re a single parent, consider budgeting strategies tailored to your situation. If you’ve tried solutions but still need help, we’re here to guide you toward better options. Learn more about debt relief in Saskatchewan or book a free consultation with us.

Personal debt in the Territories

Due to small populations in Nunavut, Yukon, and the Northwest Territories, insolvency filing numbers are also low, resulting in insufficient data.

If you are from any of the territories and are struggling with debt, that doesn’t mean you can’t find help. We are able to provide remote insolvency services to people in these areas looking for a financial fresh start. Book a free consultation today.

Sources

Grant Thornton Debt Solutions – How Much Debt Is Normal for Your Age

https://gtdebtsolutions.com/en/debt-help-resources/articles/how-much-debt-is-normal-for-your-age

Equifax Canada – Consumer Credit Trends Report Q1 2025

https://assets.equifax.com/assets/canada/english/consumer-trends-report-2025-q1-en.pdf

Statistics Canada – Labour Market Outcomes Research – 11‑633‑X2025003

https://www150.statcan.gc.ca/n1/en/pub/11-633-x/11-633-x2025003-eng.pdf

Spergel – Average Cost of Living in Canada

https://www.spergel.ca/learning-centre/general/average-cost-of-living-in-canada/

Narcity – Average Grocery Prices in Canada by Province (2025)

https://www.narcity.com/average-grocery-prices-canada-by-province-2025

Immigration News Canada – New Average Rent in Canada Reaches Record High

https://immigrationnewscanada.ca/new-average-rent-in-canada-record-high/

Spring Financial – Average Income by Province in Canada

https://www.springfinancial.ca/blog/lifestyle/average-income-by-province-in-canada

AutoTrader Canada – AutoTrader Price Index – March 2024

https://www.autotrader.ca/editorial/20240419/autotrader-price-index-march-2024

ARC Insurance – Average Car Insurance Rates Across Canadian Provinces

https://www.arcinsurance.ca/blog/average-car-insurance-rates-across-canadian-provinces/

Spring Financial – Average Home Prices in Canada

https://www.springfinancial.ca/blog/lifestyle/average-home-prices-in-canada

Daily Hive – Post‑Secondary Education Tuition Costs Across Canada

https://dailyhive.com/canada/post-secondary-education-tuition-canada-provinces-cost

Statistics Canada – The Daily: Canadian Mortgage Borrowing Update (2022)

https://www150.statcan.gc.ca/n1/daily-quotidien/220921/mc-b001-eng.htm

Statistics Canada – Economic and Social Reports: 11‑621‑M2024010

https://www150.statcan.gc.ca/n1/pub/11-621-m/11-621-m2024010-eng.htm

Take the first step to debt freedom

Speak to one of our debt solutions professionals during a free, no-obligation consultation.

Related articles

Loading