What Canada’s 2025 federal budget could mean for your taxes—and your wallet

CPA, CIRP, Licensed Insolvency Trustee

CPA, CIRP, Licensed Insolvency Trustee

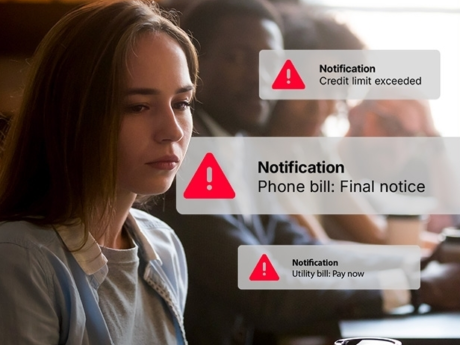

If you’re one of the many Canadians juggling bills, debt, and rising costs, the 2025 federal budget (Budget 2025) brings changes that could help ease the pressure. From tax cuts to automatic benefit filing, these measures could put more money in your pocket and make it easier to access the support you’re entitled to—without extra paperwork or stress. Here’s what’s coming and how it could help you:

Middle-class tax cut

The personal income tax rate will drop from 15% to 14.5% in 2025, and then to 14% in 2026 and beyond. This means that you pay less tax on the first portion of your income in the lowest tax bracket. To help ensure no one ends up paying more because of this change, the government will introduce a top-up tax credit that keeps the value of certain non-refundable credits at the current 15% rate until 2030. For example, if you earn $50,000, you’ll pay $7,250 in tax at the new 14.5% rate in 2025 instead of $7,500 at 15%, and $7,000 at 14% in 2026—saving up to $500 compared to today.

Why it matters: Less tax coming off your paycheque means more breathing room for everyday expenses or debt repayment.

Automatic filing for benefits

Starting for the 2025 tax year, the Canada Revenue Agency (CRA) will have the authority to file a tax return on your behalf if you meet certain income criteria. This means you could still receive benefits like the GST/HST Credit, Canada Child Benefit, or Canada Workers Benefit even if you don’t file a return yourself.

Why it matters: If you’ve skipped filing because of complexity or cost, you could still receive helpful government payments automatically.

Assistance for Personal Support Workers

From 2026 to 2030, eligible personal support workers will be able to claim a refundable tax credit worth 5% of their earnings, up to $1,100 per year. This applies to those working in hospitals, nursing homes, and other regulated healthcare settings.

Why it matters: A meaningful boost for those in caregiving roles to help offset living costs.

Disability support

The federal government will provide a one-time $150 payment to help offset the cost of applying for the Disability Tax Credit. It also plans to make the Canada Disability Benefit tax-free under the Income Tax Act.

Why it matters: More financial support for Canadians living with disabilities and their families.

Home and medical expense rules

Starting in 2026, you can no longer claim the same expense under both the Home Accessibility Tax Credit (HATC) and the Medical Expense Tax Credit (METC). Today, if you renovate your home for accessibility—like adding a wheelchair ramp—you can often claim the cost under both credits. That option will end.

The HATC lets you claim up to $20,000 in eligible home renovations for seniors or those eligible for the Disability Tax Credit. The METC covers a wide range of medical and disability-related expenses once you pass an income-based threshold. Under the new rule, you’ll need to choose which credit gives you the bigger benefit.

Why it matters: Plan ahead for renovations or accessibility upgrades to maximize your credits.

Carbon rebate phase-out

The federal fuel charge ended on April 1, 2025, and Canadian Carbon Rebate payments will stop after October 30, 2026, for late-filed returns.

Why it matters: If you’re eligible for the rebate, make sure you file your taxes on time to receive it before the program winds down.

Registered Plans Simplification

Starting in 2027, the government plans to streamline the rules for registered retirement savings plans (RRSPs) and tax-free savings accounts (TFSAs).

Currently, the rules around what qualifies as an investment—especially for small businesses—are complex and can discourage Canadians from diversifying their portfolios. The new approach will replace the old “registered investment” regime with clearer categories of qualified investments.

Why it matters: If you’re trying to pay down debt and save for the future, having simpler, more flexible investment options can help you make your money work harder without unnecessary red tape.

Additional measures

- Basic personal amount increase: Rises to $16,375 in 2025, reducing taxable income for all filers.

- Canada workers benefit boost: Up to $1,550 for singles and $2,950 for families.

- GST relief for first-time home buyers: No GST on new homes up to $1M.

- Banking fee reductions: Faster cheque access and lower fees planned.

- Climate action incentive payment increase: Higher quarterly payments for households.

- RRSP and TFSA limit increases: More room to save tax-free.

Budget 2025 also includes measures aimed at protecting Canadians from unlicensed debt advisors and companies. The proposal would add civil remedies—such as restitution—for violations of the Bankruptcy and Insolvency Act and significantly increase maximum criminal fines.

For consumers, this underscores the importance of seeking help from federally regulated professionals. Licensed Insolvency Trustees (LITs), like those at Grant Thornton, are the only professionals who can reduce or eliminate debt and legally stop collection calls and other creditor actions.

Many of the measures proposed in Budget 2025 are meant to help Canadians tackle the rising cost of living. However, to access them, you must be up to date on filing your taxes. Don’t let the fear of owing CRA tax debt stop you from filing and receiving important government benefits like those announced in Budget 2025.

If you’re dealing with unmanageable debt, we're here to help. A consumer proposal or bankruptcy could help you get up to date on your taxes, reduce your unsecured debts (like CRA debt), and regain access to government financial support. Book your free consultation with one of our compassionate debt solutions professionals to learn more.

Take the first step to debt freedom

Speak to one of our debt solutions professionals during a free, no-obligation consultation.

Related articles

Loading