5 questions to help you plan a debt-free wedding

Weddings are exciting, joyful, and—let’s be honest—expensive. In Canada, the average wedding now costs over $30,000 and that number keeps climbing year after year. A 2019 study found that nearly one third of Canadian couples went into debt for their wedding. This was even before the pandemic raised prices on everything from venues to flowers. A more recent study from 2024 showed that 56% of American newlyweds took on debt to pay for their wedding. While the memories may last a lifetime, the debt can linger just as long.

You don’t have to start your marriage in the red. With some planning, honesty, and clear financial goals, you can have a debt-free wedding. If you’re dreaming of a beautiful day without the burden of wedding debt, start by asking yourself these five key questions.

Want to follow along with our debt-free wedding worksheet? Download it here. It's fillable, printable, and most importantly—free!

What are your wedding priorities?

Before you dive deep into planning, take a step back and ask: what really matters to us? Is it the perfect wedding venue? The most delicious food? A large guest list? An extravagant dress? You may not be able to afford everything—but you can budget for the things that matter most.

Sit down with your partner and make a list of your top three wedding priorities. Maybe it’s having all your loved ones there, maybe it’s great photos, or maybe it’s the best DJ and a dance floor that stays packed all night long. Once you know what you value most, you can start trimming the rest. This might mean skipping the custom calligraphy on the invites or opting for a buffet instead of a plated dinner. It’s important to put your budget towards what matters most to you and your soon-to-be spouse.

What’s your wedding budget—and how will you stick to it?

Your wedding budget should reflect your reality—not your dreams. Start by looking at your current savings, income, and any contributions from your families. Then, set a realistic number that you and your partner are both comfortable with. Don’t forget to include extras like tips, transportation, and your marriage license.

Once you have your number, break it down by category: venue, food, attire, décor, and more. Use a spreadsheet or a wedding budget app to keep track of every dollar. Build a 5-10% buffer for unexpected costs—because they will come up.

Most importantly, don’t treat your budget like a suggestion—treat it like a contract. If you can’t afford something without going into debt, it’s not in the budget.

Are you willing to scale your celebration back?

If your dream wedding is out of reach financially, are you willing to scale back? This could mean inviting fewer guests, choosing to have an off-season or weekday wedding, or hosting your reception at a community hall instead of a hotel. Consider shopping for a dress at an outlet store or during a sample sale. You could also skip the videographer and DIY the décor—you can even ask family and friends to help with that part.

Scaling back doesn’t mean settling—it means being intentional. Focus on what matters and let go of what doesn’t. After all, the most important part of the day is that you’re marrying the person you love.

Do you have any other financial goals as a couple?

Before you drop tens of thousands on a one-day celebration, it might be worth asking: what else am I saving for? It could be a down payment for a house, starting a family, going on a nice honeymoon, or building an emergency fund. These goals matter just as much—if not more—than a single day of celebration. Consider how much of your savings towards these others goals you are willing to sacrifice for your wedding.

If your dream wedding is out of reach right now, it’s perfectly okay to wait a little longer to get married. A long engagement gives you more time to save, plan, and avoid debt. You can set up a dedicated wedding savings account and contribute to it monthly. Even $100 a month adds up—and it’s a lot better than paying off a high-interest credit card later.

With more time, you’ll have more flexibility to shop around, negotiate with vendors, and take advantage of off-season deals. You’ll also reduce stress and give yourself space to plan a wedding that truly reflects your values—without compromising your financial future.

Do you have a plan to pay off wedding debt?

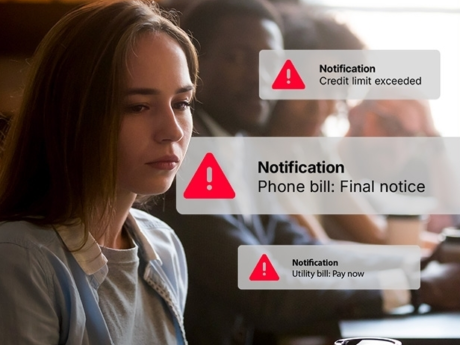

Your wedding is one day, but your credit card debt can last years. Starting this new chapter of your lives together with a mountain of wedding debt can delay other financial goals and add stress to your relationship. That’s why more couples are choosing to say “I don’t” to wedding debt and “I do” to financial freedom. Are you ready to put these tips into action? Download our debt-free wedding budget worksheet to help you get started.

If you’re already feeling overwhelmed by wedding costs—or carrying other debt that’s making it hard to save—we’re here to help. Book a free consultation with one of our debt solutions professionals. We can help you understand your options and take control of your finances.

Take the first step to debt freedom

Speak to one of our debt solutions professionals during a free, no-obligation consultation.

Related articles

How much debt is normal in your province?

Can I file for bankruptcy if I own a house?

What Canada’s 2025 federal budget could mean for your taxes—and your wallet

4 common investment scams and how to avoid them

Is AI your new best budget buddy?

Should I get a store credit card?

The rising cost of friendship in Canada

Looking for assurance, tax, and business advisory services? Visit Doane Grant Thornton LLP.

Loading