8 debt warning signs (and what to do when you spot them!)

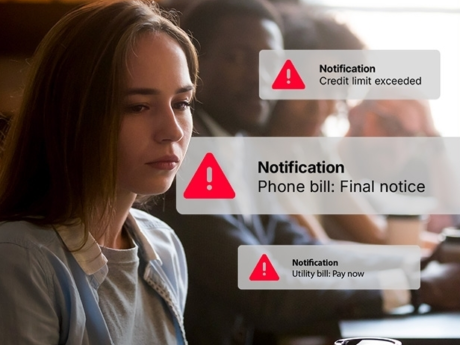

Debt is a part of life for most people, which can make it hard to tell how much debt is ‘normal’ for your age and what a debt problem looks like. Being able to recognize debt warning signs can help you ditch bad financial habits and prevent serious debt problems.

People take on debt for a variety of reasons. For some, financial trouble can occur unexpectedly from an emergency expense or job loss. For others, a debt-prone spending personality can lead to high levels of debt. But, for most, debt gradually builds over time and typically doesn’t present itself as a problem until it’s unmanageable.

So, how do you know when you need help with your debt? Here are eight common debt warning signs—the more that apply to you, the more concerning your financial situation might be.

8 common debt warning signs

- You can only make the minimum payment on your credit card.

- You pay interest and service charges on your debt because you can’t pay on time.

- You receive collection calls for non-payment of overdue bills.

- You don’t follow a budget or spending plan.

- You take cash advances from your credit card or use payday loans to keep up with monthly living expenses.

- You hide overspending from your family or partner.

- Your wages are being garnished or your assets are being seized.

- You constantly worry about your debt.

If any of these looks familiar, you may have a debt problem—or be heading for one.

What to do when you spot a debt warning sign

The good news is that identifying the problem is part of the solution. If you’re wondering what your next step should be, we suggest speaking with a Licensed Insolvency Trustee. Since everyone’s story is unique, we start by understanding your current financial situation, which allows us to determine all your options and describe what each debt relief solution would look like for you.

If you’re looking for support and want to learn more about your debt relief options, we’re here to help. Book your free, no-judgment consultation and start the road to debt freedom today. We look forward to helping you find the right debt solution for you.

Take the first step to debt freedom

Speak to one of our debt solutions professionals during a free, no-obligation consultation.

Related articles

Can I file for bankruptcy if I own a house?

What Canada’s 2025 federal budget could mean for your taxes—and your wallet

4 common investment scams and how to avoid them

Is AI your new best budget buddy?

Should I get a store credit card?

5 questions to help you plan a debt-free wedding

The rising cost of friendship in Canada

Looking for assurance, tax, and business advisory services? Visit Doane Grant Thornton LLP.

Loading