Dating and debt: Love in a cost of living crisis

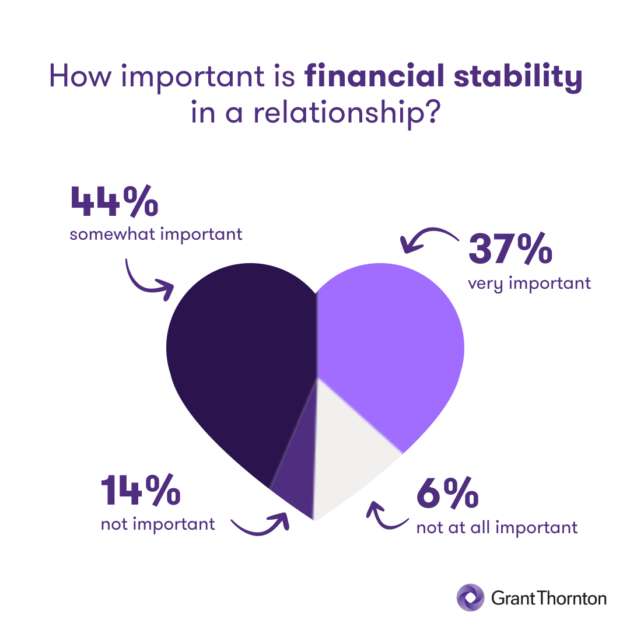

Despite what Hollywood might want us to think, money plays a leading role in the pursuit of love. While society has shifted from doweries and breadwinners to splitting the bill on a first date, 98% of Canadians still believe that financial stability is necessary for a happy and successful relationship. With the average Canadian owing more than $21,000 of non-mortgage debt, does love truly not cost a thing? To explore this topic, we asked Canadians their thoughts on dating with debt and how important finances are to a relationship.

Finding your other half

Can you “go steady” without financial stability? Four out of five Canadians claim to take finances into account when searching for a potential partner.

Does love really not cost a thing? One in five Canadians say they’ve had to cut back or stopped dating completely because of money issues.

When to discuss debt in a relationship

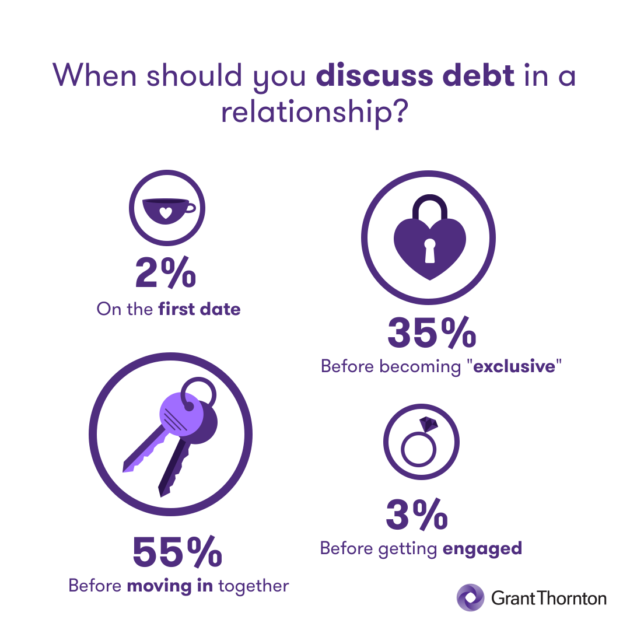

Till debt do us part? One third of Canadians have had a romantic relationship negatively impacted by debt. To prevent this, most Canadians (55%) prefer to discuss finances before moving in together. An additional 35% prefer to have the money talk before becoming "official" or "exclusive".

Staying together for financial reasons

You, me, and the economy. One in four Canadians have stayed in an unhappy relationship for financial reasons. The top financial concerns keeping unhappy couples together are cost of living, rent, shared assets, and debt. Another quarter of unhappy couples stay together to avoid the cost of divorce. Learn what divorce could mean for your finances.

Debt isn’t a dead end.

Debt can be an isolating experience, but it shouldn’t hold you back from enjoying or creating relationships, whether romantic or not. If you’re ready to start a new relationship with your money, our debt solutions professionals are here to help. With the help of a Licensed Insolvency Trustee, you can take back control of your financial future through a bankruptcy or consumer proposal. Book your free, non-judgmental consultation today to start your journey to debt freedom.

Take the first step to debt freedom

Speak to one of our debt solutions professionals during a free, no-obligation consultation.

Related articles

Family finance: The emotional cost of financially supporting family

Caught in the odds: Understanding gambling debt and how to get help

How can a Licensed Insolvency Trustee help with my debt?

Do you owe CERB debt? Here's what Canadians need to know about repayment

How much debt is normal in your province?

Can I file for bankruptcy if I own a house?

4 common investment scams and how to avoid them

Looking for assurance, tax, and business advisory services? Visit Doane Grant Thornton LLP.

Loading