Money management

38

articles

Family finance: The emotional cost of financially supporting family

With rising costs, increased debt loads, and tighter budgets, many Canadians turn to family for support. Whether it’s helping an adult child get back on their feet, lending money to a sibling, or opening your home to a relative, financial support within families is common across the country. In fact, over half (53%) of Canadians gave money to relatives last year. But money can also strain relationships, create pressure, and sometimes lead to debt on both sides of the conversation.

Caught in the odds: Understanding gambling debt and how to get help

With the rapid expansion of online casinos and sports betting, gambling has become more accessible—and more tempting—than ever. What used to require a trip to the casino now lives in your pocket. It’s no surprise that gambling related financial problems have climbed.

How can a Licensed Insolvency Trustee help with my debt?

Personal debt has a way of popping up like weeds—one minute everything’s fine, and the next you’re wondering how things got so out of control. The good news is you don’t have to tackle the cleanup on your own. Licensed Insolvency Trustees are federally regulated, highly trained, and genuinely committed to helping people step out of debt and into a fresh financial start.

Do you owe CERB debt? Here's what Canadians need to know about repayment

Even though the Canada Emergency Response Benefit (CERB) wrapped up years ago, thousands of Canadians are still dealing with repayment letters, reassessments, and confusion about what they owe. If you’re one of the many Canadians surprised to see CERB debt show up on your CRA account, or you’re experiencing wage garnishments or deductions on government payments, you’re not alone—and you do have options for dealing with CRA debt.

How much debt is normal in your province?

Having debt is a reality for most Canadians—whether it’s student loans, credit cards, or car payments. But can the province you live in impact the amount of debt you have, and how does it compare to the rest of Canada?

What Canada’s 2025 federal budget could mean for your taxes—and your wallet

If you’re one of the many Canadians juggling bills, debt, and rising costs, the 2025 federal budget (Budget 2025) brings changes that could help ease the pressure. From tax cuts to automatic benefit filing, these measures could put more money in your pocket and make it easier to access the support you’re entitled to—without extra paperwork or stress.

4 common investment scams and how to avoid them

Online banking, cryptocurrency, and AI have opened doors to exciting financial opportunities—but it’s also created a playground for scammers. Last year, Canadians lost $643 million to fraud, according to the Canadian Anti-Fraud Centre. Keep reading to learn more about common investment scams and how to avoid them.

Is AI your new best budget buddy?

When most of us think about managing our finances we think spreadsheets, calculators, and at times, a whole lot of guesswork. But today, many people are adding artificial intelligence to their tool kit.

Should I get a store credit card?

Store credit cards—like those from grocery stores or even coffee shops—can seem like a smart way to save money while shopping. Signing up may earn you bonus points, cash back, or exclusive discounts. But these cards are more than just loyalty programs; they are real credit cards that come with real consequences if they’re not paid.

5 questions to help you plan a debt-free wedding

Weddings are exciting, joyful, and—let’s be honest—expensive. But you don’t have to start your marriage in the red. With some planning, honesty, and clear financial goals, you can have a debt-free wedding.

The rising cost of friendship in Canada

Our latest survey reveals that for many Canadians, financial strain is quietly reshaping how we socialize, support, and sustain our friendships.

What happens if your employer goes bankrupt?

Work plays a major role in our lives—after all, most full-time employees in Canada spend 40+ hours a week on the job. While your job can be fulfilling, it can also bring stress—especially when uncertainty arises. If your employer is experiencing financial trouble, it’s natural to feel concerned about what that could mean for your future.

How to rent in Canada with bad credit

Debt can impact more than your bank account. It can affect your relationships, your mental health, and even your ability to find a place to live. Buying a house isn’t an option for everyone. Typically, renting is the alternative, but if you’re dealing with bad credit, you might be wondering if renting an apartment is even possible. It is—but it might take a little extra effort.

How to build credit in Canada: A guide for beginners

Whether you’re new to Canada, new to independent living, or looking for a new financial start, understanding credit is essential to achieving a stable financial future. Credit can be confusing at first, but once you understand how it works—and how to build it—you’ll be in a much better position to rent an apartment, buy a car, or even get a mortgage.

How to budget as a single parent

Being a single parent comes with unique financial challenges. With only one income, managing the cost of living can be difficult and increase the risk of falling into debt. But debt isn’t a dead end—there are strategies and resources available to help you manage financial pressures.

How tariffs impact Canadians—and how to prepare if you’re facing debt

Since US President Donald Trump took office in January 2025, tariffs and their impact on Canada’s economy have dominated the headlines.

4 ways to spot and avoid romance scams

The internet can be a great tool to connect with people you might have never met, but it can be a double-edged sword. The progress of AI has made romance scams easier than ever to pull off and harder than ever to detect.

How does car repossession work and how can I avoid it?

Car loans are a significant part of household debt. If you don’t own a home, your vehicle may be your most valuable asset. We've put together answers to the most common questions about car repossession in Canada to help you understand what to expect and what you can do to avoid it.

Should I use a HELOC to pay down debt?

As you pay down your mortgage, the equity tied in your home can be an appealing asset to manage financial stress. A Home Equity Line of Credit (HELOC) lets you use the equity in your home to cover large expenses or pay off debt, but is it worth the risk?

How to budget on an irregular income

Budgeting is different when you have an irregular income. Whether you’re a freelancer, business owner, seasonal worker, or part of the gig economy, this guide can help you create a stable monthly budget.

Mastering the "money talk" as a couple

As dating evolves into a partnership, it’s crucial to tackle meaningful—and sometimes difficult—conversations. One of the most important—yet often avoided—conversations is the “money talk.”

Saving for a rainy day: How to start an emergency fund

We've all been told to save for a "rainy day", but many Canadians won’t have money left over at the end of today. In 2024, 66% of Canadians had to cut back on saving to cover the high cost of living. So, if that’s the reality, why should Canadian's set money aside for a rainy day when they’re still in the middle of the storm?

Do I get paid while on strike? And other financial concerns

From negotiations to the picket line, a strike makes your day-to-day schedule—and your finances—unpredictable. Whether you’re part of a public service, private, or trade union, we’ve addressed four common financial concerns you might have while on strike.

How to read your credit report

When accessing your credit report, the structure and terminology may seem intimidating—but we’ve got you covered. We’ve pulled together a simple guide on how to make a healthy habit out of accessing and reviewing your credit report on a yearly basis.

Price shock: How Canadians are coping with the rising cost of living

Rising costs are taking a toll on nearly all Canadians. However, the impact is felt more acutely by low-income households and those carrying debt. See our insights on how Canadians are coping.

A guide to managing your finances for the newly unemployed

If you've recently experienced unemployment and are wondering what’s next for you financially, we’ve created a guide to managing your finances as newly unemployed.

Avoid overspending with this simple mindset shift

Is a deal really a deal if you’re going into debt? We’ve decoded what makes a ‘good deal’ and how even the best bargains can break your budget.

Buy now, pay later? The real cost of buy now, pay later programs

If you shop online, you’ve likely come across a “Buy Now, Pay Later” option on the checkout page. We’ve broken down the information you need to know before you buy now and pay later.

Should I use my RRSP to pay off my debts?

If you’re thinking about withdrawing from your RRSP to pay off debt, make sure you consider the consequences before deciding to dip into your retirement savings.

What does an interest rate increase mean for Canadians with debt?

To help you understand the implications of an interest rate increase, we’re breaking down why the Bank of Canada made the increase and what it might mean for you.

Family finance 101: A simple way to talk to your kids about money

The benefits of holding a family finance meeting—finding new budgeting strategies, ways to cut unnecessary expenses, reducing financial stress—are countless and the results might surprise you.

5 ways to pay off debt fast

We’ve pulled together 6 of our best strategies that can get you out of debt and back to being you.

The link between mental and financial health

The relationship between your financial and mental health is a close one. Explore tips on how you can manage your finances to improve your mental health.

The top 5 factors that affect your credit score

When it comes to credit, what you don’t know can hurt you. We’ve created a simple guide on how to access, understand, and improve your credit score.

Which spending personality are you?

Have you ever set a financial goal only to let old spending habits take over? Discover your spending personality type to see how you could be held back financially.

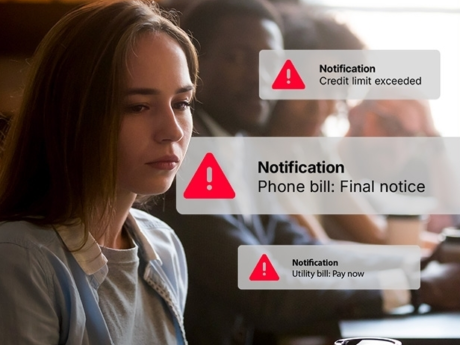

8 debt warning signs (and what to do when you spot them!)

Recognizing debt warning signs can help you ditch bad financial habits and prevent serious debt problems. Learn about some common warning signs.

Avoiding tax debt for the self-employed

If you have outstanding income tax debt with the CRA, you should deal with it sooner than later. Options are available to help you overcome income tax debt.

Financial goal setting: 7 realistic examples you can achieve

Setting achievable financial goals gives you a sense of direction, helps guide decision-making, and is a source of motivation.

Take the first step to debt freedom

Speak to one of our debt solutions professionals during a free, no-obligation consultation.

Explore specific debt help topics

I want to learn more about:

Loading