- Debt relief starts here

- Who we are

-

-

Our locations

-

Debt Relief in Alberta

-

Debt relief in British Columbia

-

Debt relief in Manitoba

-

Debt relief in New Brunswick

-

Debt relief in Newfoundland and Labrador

-

Debt relief in Nova Scotia

-

Debt relief in Nunavut

-

Debt relief in the Northwest Territories

-

Debt relief in Ontario

-

Debt relief in Prince Edward Island

-

Debt relief in Saskatchewan

-

Debt relief in the Yukon

-

How to make a basic budget—and stick to it

A budget is one of the most important financial tools. You can think of it as a roadmap for taking control of your finances, giving your income a purpose, and achieving your financial goals. No matter what your financial situation looks like, what your financial goals are, or what your income is—you can make a realistic budget that works for you.

Many people don’t know where to begin–and that’s ok! We've outlined three simple steps to create a basic budget that will help get your finances in order.

How to make a basic budget

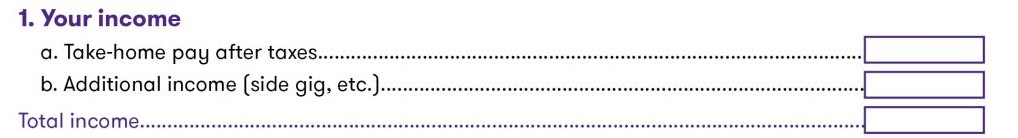

Step 1: List your monthly income

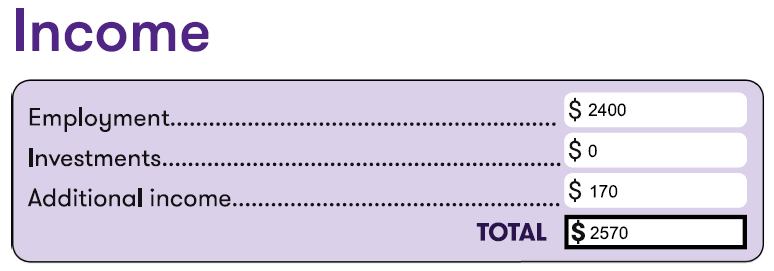

Start by determining your monthly income—this includes your normal paycheque, side gigs, freelance work, and other contributors in your household. If you have a yard sale and earn some extra cash, that’s income can be added to your budget! If your income is commission hours based, try to estimate the amount you will receive for the month. Here’s an example of how to list your income:

Step 2: List your household expenses

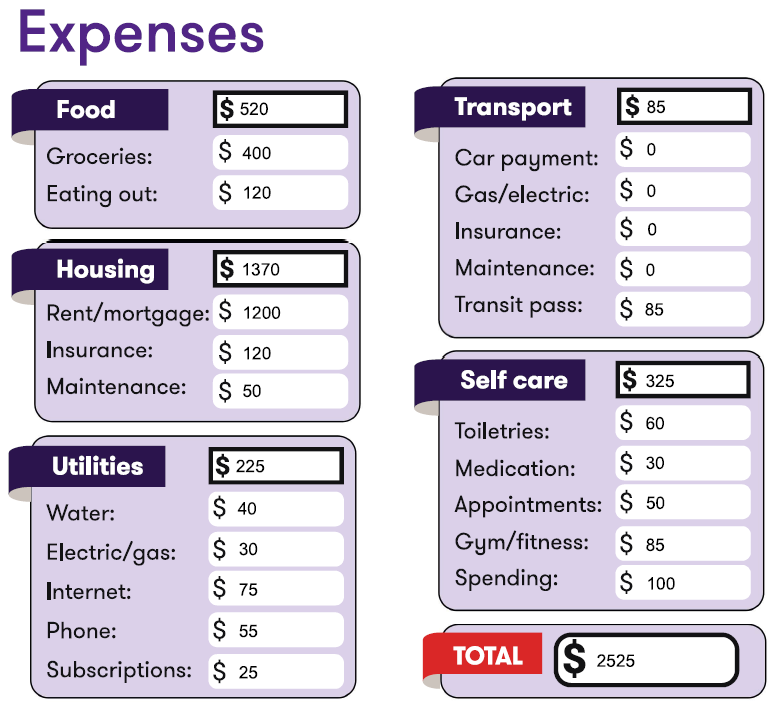

Now that you know how much money is coming in, you can prepare for what money will be going out. Start by listing all your fixed monthly household expenses—these are expenses that stay the same every month like rent, car loan payment, debt payments, childcare, and household utilities. You can also include money that goes towards your financial goals as a fixed expense, like contributing to a vacation fund or RRSP.

Next, list your variable expenses—these expenses change each month and will require some estimation. Variable, or irregular expenses, include groceries, gas, entertainment, travel, clothing, dental, etc.

Pro tip: Open your bank statement and review the last month. In addition to seeing all your fixed expenses, you'll be able to estimate what you typically spend per month on irregular expenses.

Here’s an example of how to list your expenses, broken down by category:

Step 3: Subtract your expenses from your income

Using a calculator, subtract your total monthly expenses from your total monthly income. Three things can happen here:

- If your expenses are higher than your income, you’ll need to adjust your monthly budget by cutting out non-essential expenses. You’ll know this is the case if you calculate a negative number.

- If your expenses are the same as your income, you've created a net-zero budget meaning all your money is spoken for. In other words, each dollar has a job, whether it be spending, saving, or paying off debt. If possible, try to reduce your monthly expenses to leave some wiggle-room in the event an unexpected expense arises.

- If your income is higher than your expenses, you’ll have left over money in your account that should be given a job. This doesn't mean spend it, but rather give it a purpose or direct it towards a financial goal. You could contribute to your RRSP, pay down debt, or build an emergency fund.

It’s important to remember that you can adjust your budget and that nothing is set in stone. If you cut out an expense, that ‘extra’ money can be given a new job, like saving up for a down payment. A budget allows you to control your money and ensure every dollar you earn is working in your favour.

How to stick to your budget

Choose a format that works. Your budget should make sense to you and be easy to reference, whether it’s an online budget template, a free budgeting app, or a page in your notebook.

Reference it often. Use your budget to help make spending decisions and to keep yourself within your limits. This is a proven way to avoid overspending.

Review it monthly. Reviewing and adjusting your budget monthly will allow you to stay on top of your income and expenses, get closer to your goals, and avoid financial trouble.

Set reminders. If you think you’ll have trouble remembering to check your budget monthly, set a reminder on your phone, mark time to review your budget on your calendar, or enlist a friend as a “budget buddy” to hold each other accountable.

Creating a budget and sticking to it might seem simple, but that doesn’t mean it will be easy. Remember that budgeting can take time to get used to and that results won't happen overnight. Take it one step at a time, find motivation along the way, and focus on the financial goals you plan to achieve. Before you know it, you’ll see the results of your hard work and dedication.

Take the first step to debt freedom

Speak to one of our debt solutions professionals during a free, no-obligation consultation.

Related articles

How to budget as a single parent

How tariffs impact Canadians—and how to prepare if you’re facing debt

How to budget on an irregular income

Mastering the "money talk" as a couple

Saving for a rainy day: How to start an emergency fund

Do I get paid while on strike? And other financial concerns

What is a student line of credit?

Looking for assurance, tax, and business advisory services? Visit Doane Grant Thornton LLP.

Loading